Price of Dogecoin: Live DOGE Value, Chart, and Market Trends

Dogecoin, once launched as a lighthearted cryptocurrency in 2013, has evolved into a significant player in the digital asset space. Originally created as a joke, Dogecoin (DOGE) has since amassed a passionate community, caught the attention of celebrities and high-profile entrepreneurs, and demonstrated notable volatility in its price trajectory. The journey of Dogecoin’s value, coupled with its unique market drivers, positions DOGE as an intriguing case study in the broader world of cryptocurrencies.

Real-Time Dogecoin Price and Influencing Factors

At any given moment, the price of Dogecoin reflects a dynamic interplay between investor sentiment, market momentum, and emerging use cases. Like most cryptocurrencies, DOGE’s value is quoted against USD and fluctuates rapidly—the result of high trading volumes across both centralized exchanges and decentralized platforms.

Key Determinants of Dogecoin’s Price

Dogecoin’s price responds to several key market factors:

-

Market Sentiment: Social media mentions, trending hashtags, and viral posts (notably those involving Elon Musk) can cause sharp swings in DOGE’s price. For instance, a single tweet by Musk has, on more than one occasion, led to dramatic upward surges.

-

Trading Volume and Liquidity: As one of the most widely held and traded cryptocurrencies globally, Dogecoin experiences robust liquidity—which can both cushion and amplify price movements.

-

Supply Dynamics: Unlike Bitcoin’s fixed supply, Dogecoin’s supply is effectively unlimited, with roughly 5 billion new DOGE coins issued annually. This inflationary model affects long-term valuation and market perceptions.

-

Broader Crypto Trends: Macroeconomic shifts, regulatory updates, and the performance of leading cryptocurrencies (like Bitcoin and Ethereum) often create spillover effects on DOGE.

Dogecoin’s price is thus shaped by a tapestry of psychological, technological, and macroeconomic factors—making real-time tracking essential for traders and investors alike.

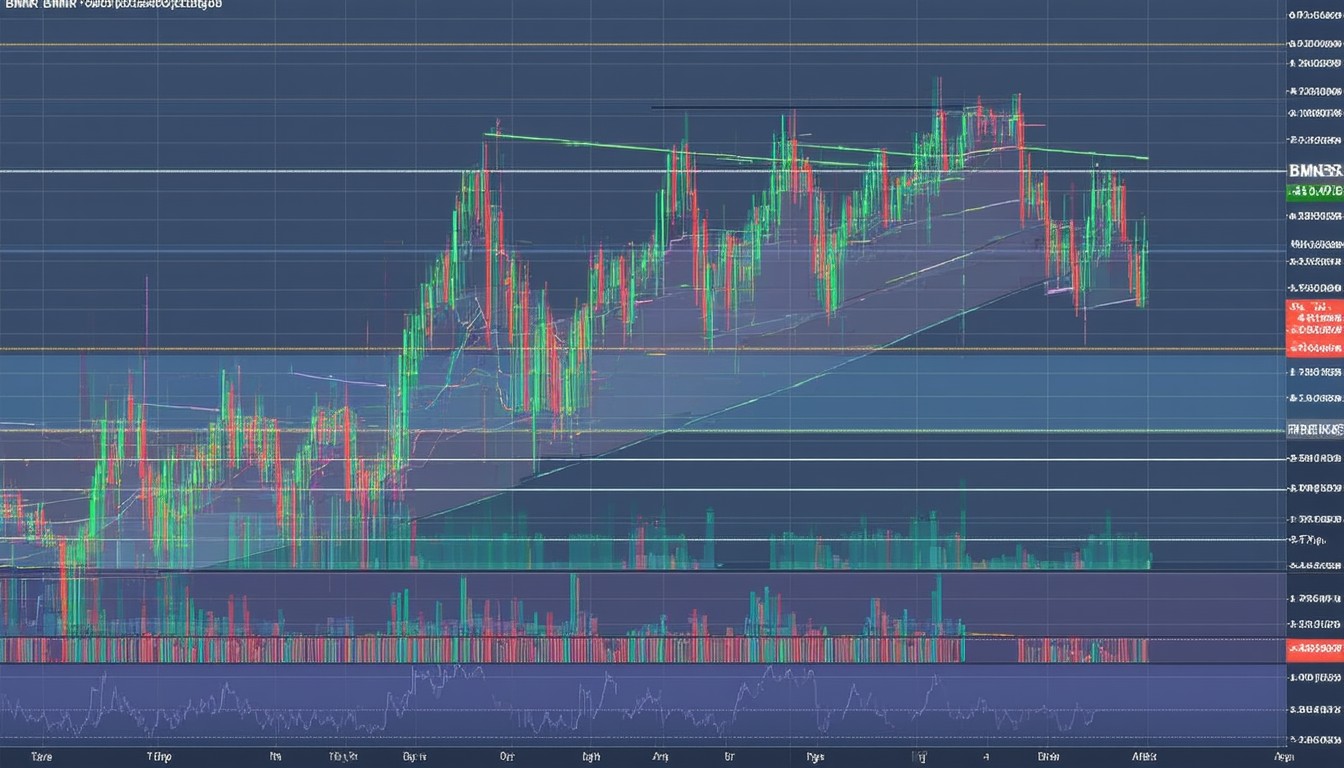

Charting Dogecoin: Historical Peaks, Crashes, and Growth

A look at Dogecoin’s price chart over time reveals a cryptocurrency that has undergone dramatic cycles of hype, retracement, and stabilization.

Major Price Milestones

-

Early Years (2013–2017): Dogecoin traded at fractions of a cent, with price movement mostly driven by online communities and tipping culture.

-

2017 Crypto Bull Run: DOGE reached new highs, correlating with the mainstream rise of Bitcoin and Ethereum.

-

2021 Surge: Perhaps the most notable moment in Dogecoin’s history occurred in early 2021. Social media campaigns, coupled with tweets from high-profile figures and intense media coverage, propelled DOGE to an all-time high near $0.70 USD. At that time, Dogecoin found itself among the top five cryptocurrencies by market capitalization.

-

Subsequent Volatility: After peaking in 2021, Dogecoin’s price corrected alongside the broader crypto market, with periods of high volatility and ongoing speculation regarding future use cases.

“Dogecoin’s price history underscores how digital assets can be deeply influenced by online culture and network effects—sometimes more so than traditional fundamentals,” notes Molly White, a cryptocurrency researcher and technology commentator.

Visualizing Trends and Technical Analysis

For traders, Dogecoin’s candlestick charts and trend lines are more than patterns—they represent the collective psychology of millions of retail and institutional participants. Analysts often look to support and resistance levels, as well as moving averages, to interpret where DOGE’s price might move next.

Noteworthy trends include:

- Parabolic Rallies: Often fueled by viral interest

- Steep Corrections: As sentiment cools or profit-taking occurs

- Stabilization Periods: DOGE has shown the capacity to maintain price floors above previous cycle highs, reflecting ongoing community adoption

What Sets Dogecoin Apart: Community, Utility, and Celebrity

Beyond price action, Dogecoin’s distinctiveness lies in its robust online community and unconventional path to relevance.

The Power of Community

Dogecoin’s Reddit forums and Twitter hashtags have served as catalysts for mass mobilization—a phenomenon exemplified during the 2021 “Doge Day” rally. Unlike many projects that rely strictly on technological innovation, Dogecoin leverages grassroots enthusiasm, organic memes, and a “for the people” ethos.

Real-World Adoption and Utility

While originally dismissed as a meme coin, Dogecoin has gradually found practical applications:

- Tipping and Microtransactions: Thanks to low transaction fees, DOGE is popular for peer-to-peer tips on social platforms.

- Payments and Sponsorships: A growing, albeit modest, number of retailers and organizations accept Dogecoin for goods, services, and donations.

The ‘Elon Musk Effect’ and Media Attention

A distinguishing feature in DOGE’s price story is the influence of celebrity attention. The so-called “Elon Musk Effect” describes the outsized impact tech personalities can have on speculative assets.

For example, Musk’s appearances on “Saturday Night Live” and frequent Dogecoin-related Tweets have repeatedly moved DOGE’s price, highlighting new dynamics in the intersection of media, technology, and finance.

Navigating Risks and Volatility in Dogecoin

Despite Dogecoin’s popularity, its volatility presents tangible risks. Price swings of 10% or more in a single day are not uncommon, and these moves are often untethered from traditional economic indicators.

Short- and Long-Term Considerations

Investors in Dogecoin must weigh several factors:

- Lack of Supply Cap: The inflationary model means Dogecoin is less likely to become a “store of value” in the traditional sense compared to Bitcoin.

- Regulatory Uncertainty: As governments examine the broader crypto space, meme coins such as DOGE may attract increased scrutiny.

- Technical Stability: Dogecoin’s underlying technology is secure but considered less innovative compared to newer blockchain projects.

Still, Dogecoin’s sheer visibility ensures its continued relevance in discussions of cryptocurrency market trends—often serving as a bellwether for sentiment-driven trading.

Concluding Thoughts: What’s Next for the Price of Dogecoin?

Dogecoin’s evolution from meme to mainstream is emblematic of the broader shifts occurring in digital finance. Its story is an ongoing experiment in the power of community, humor, and unorthodox branding to shape real financial outcomes.

For investors and observers, tracking the price of Dogecoin is not merely a technical exercise—it is a window into the unpredictable and fast-moving culture of modern finance. Those interested in DOGE should stay updated through real-time data—and balance the excitement with careful risk management.

FAQs

What is the current price of Dogecoin?

The live value of Dogecoin changes constantly, as it is traded 24/7 across global exchanges. Popular finance websites and crypto platforms provide real-time charts and rates in USD and other currencies.

Why does Dogecoin’s price fluctuate so much?

Dogecoin’s price is highly sensitive to investor sentiment, social media trends, and news events. Its active trading volume and community-driven movements contribute to frequent volatility.

How is Dogecoin different from Bitcoin in terms of price behavior?

Unlike Bitcoin, which has a fixed supply, Dogecoin has no maximum cap, so new coins are continually created. This difference influences DOGE’s long-term value and how it responds to demand.

What factors could influence Dogecoin’s future price?

Future price trends may depend on celebrity mentions (like Elon Musk), broader crypto market shifts, potential use cases, or regulatory updates. Community activity and social media also play major roles.

Can Dogecoin reach new highs again?

Cryptocurrency markets are unpredictable, and while past surges have occurred, no one can guarantee similar moves. Investors should monitor market trends and make decisions based on their risk tolerance.

Is Dogecoin a good investment?

Dogecoin carries high risk and potential reward, like many cryptocurrencies. It may fit speculative strategies but is generally not viewed as a stable long-term investment compared to established assets.