BMNR Stock Price: Real-Time Quotes, Charts & Market Analysis

The financial markets in 2024 are defined by rapid changes and increased access to real-time data, allowing both institutional and retail investors to make well-informed decisions. The BMNR stock price, referring to Black Mountain Resources Ltd (ASX: BMNR) and similarly named tickers on global over-the-counter exchanges, has drawn attention from investors interested in the mining and resources sector. With its unique position in the market and exposure to global commodity cycles, tracking BMNR’s real-time quotes, chart patterns, and broader market analysis offers a window into both the company’s strategic direction and shifting investor sentiment.

Real-Time Quotes: Why Up-to-the-Minute BMNR Stock Data Matters

For traders and long-term investors alike, access to real-time stock price information is no longer a luxury but a necessity. Platforms offering BMNR stock price quotes—including financial news sites, broker terminals, and trading apps—ensure that market participants can respond swiftly to news, earnings announcements, or emerging trends.

Beyond standard price listings, many services now integrate:

- Live bid-ask spreads, showing both liquidity and volatility

- Volume trackers, highlighting unusual trading activity

- Time & sales data, providing deeper order flow insights

These features enable nuanced decision-making. For example, a sudden spike in BMNR’s trading volume following a company update may indicate new institutional interest—or, conversely, short-term speculative action.

“Real-time data transforms the way traders approach risk. The ability to see order book imbalances and instant reactions to news helps level the playing field for retail investors,” said a senior equity analyst at a leading Australian brokerage.

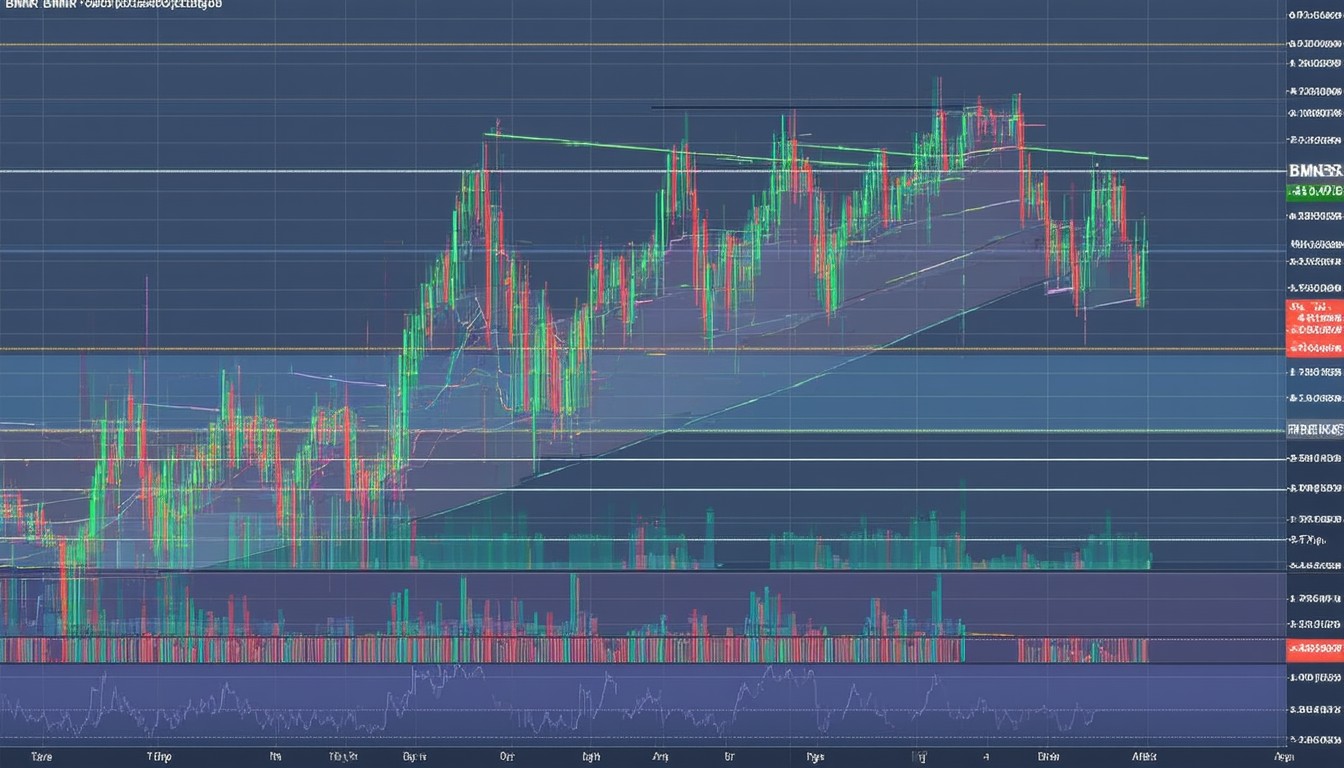

Technical Analysis: Charting BMNR Price Movements

Chart analysis is fundamental when interpreting a stock like BMNR, which can be sensitive to commodity prices, regulatory developments, and exploration success.

Key Chart Patterns and Indicators

Traders and analysts frequently employ:

- Moving averages (MA): Track trend direction and potential support/resistance.

- Relative strength index (RSI): Gauge overbought or oversold conditions.

- Volume profiles: Identify price levels with the most trading interest.

A closer look at recent BMNR charts often reveals periods of consolidation punctuated by sharp price swings. Correlations with broader mining indices or fluctuations in base metal prices (such as zinc, lead, or silver) are also informative, especially given Black Mountain Resources’ business focus.

Real-World Example

During recent industry conferences, BMNR shares mirrored price movements in major mining ETFs, illustrating how investor sentiment sometimes follows overarching commodity trends rather than company-specific news. This pattern is a hallmark of the sector and underscores the importance of contextual analysis.

Market Analysis: The Broader Forces Shaping BMNR Stock

BMNR’s valuation and future prospects hinge on several macro and microeconomic factors:

Commodity Cycles and Resources Demand

As a miner or explorer, BMNR is heavily exposed to global commodity prices. The recent rise in demand for battery metals, critical minerals, and sustainable resource extraction practices has caused many resource-linked equities to outperform laggard sectors. Government incentives and the global shift toward renewable energy have only accelerated these trends, making mining stocks, including BMNR, a focal point for growth-oriented investors.

Regulatory and Geographical Influence

Mining companies are particularly sensitive to shifts in regulation—whether due to environmental policy changes, licensing processes, or export/export tariffs. BMNR’s project geography—for example, assets in Australia or Africa—introduces further complexity as local laws and infrastructure issues can lead to cost overruns or delays.

Corporate Strategy and Financial Health

Beyond resource exposure, BMNR’s market performance is also a reflection of its capital allocation, exploration results, and management competence. Investors frequently review quarterly production figures, project updates, and financial statements to anticipate future stock price movements.

“Time and again, the mining sector teaches us that shareholder value isn’t just about the resource in the ground—it’s about steady, transparent execution and the agility to adapt to changing market conditions,” notes a resource fund portfolio manager.

Comparing BMNR with Other Mining Stocks

For context, investors often benchmark BMNR’s stock price and valuation metrics against peers and sector indices:

- Price-to-earnings (P/E) ratios and Enterprise Value/EBITDA multiples offer perspective on whether BMNR is undervalued or pricey.

- Production growth and cost-per-ounce metrics—where applicable—are vital for comparing operating efficiency.

These comparisons can highlight whether BMNR’s recent price movements are company-specific or part of wider sectoral shifts.

Mini Case Study: Mining Stocks in Volatile Markets

During the 2020–2023 commodity bull run, shares of mid-cap mining explorers often outpaced both major miners and diversified indexes. Investors who closely tracked technical signals—volume spikes on key announcements, crossovers of moving averages—were able to capture outsized gains. BMNR, operating within this context, mirrors many of these sector-wide behaviors.

Tools and Platforms for Tracking BMNR Stock Price

To stay informed, investors typically rely on:

- Online brokerages with advanced charting and news integration

- Financial news portals like Bloomberg, Reuters, and ASX-specific services

- Mobile trading apps with customizable watchlists and push notifications

Automated alerts and AI-driven analytics are increasingly popular, helping users respond to price swings and headline-driven moves. For deeper insight, institutional investors may subscribe to proprietary research platforms that incorporate company filings and industry benchmarking.

Strategic Considerations for BMNR Investors

Investing in BMNR—or any mining stock—requires balancing optimism about the underlying resource with sober consideration of operational risks and market cycles. Common strategies include:

- Diversification: Combining exposures to producers, explorers, and commodities.

- Trend-following: Using technical indicators for entry and exit timing.

- Event-driven investment: Trading around known catalysts, such as assay results or regulatory approvals.

While the potential for rapid gains exists, so too does the risk of abrupt corrections—not uncommon in the resources sector.

Conclusion: Navigating the BMNR Stock Landscape

The BMNR stock price, like many in the mining sector, is shaped by a complex interplay of real-time market dynamics, broader commodity cycles, and company-specific factors. Armed with access to reliable real-time quotes, effective chart analysis, and contextual market insights, investors can better navigate both risks and opportunities.

For those considering an allocation to BMNR, ongoing attention to global commodity trends, regulatory updates, and company news remains essential. In fast-moving markets, adaptability and continuous learning are crucial assets.

FAQs

What is BMNR stock?

BMNR typically refers to Black Mountain Resources Ltd, an ASX-listed company focused on mining and resource exploration. The ticker may also be used by other similarly named stocks in over-the-counter markets.

Where can I find real-time BMNR stock prices?

Real-time quotes are available on major financial news websites, online broker platforms, and dedicated market apps. Many services also offer advanced charting, news, and alert features.

What factors influence BMNR stock price movements?

BMNR’s stock price is affected by global commodity markets, changes in regulation, mining project updates, and overall investor sentiment in the resources sector.

How can I analyze BMNR stock trends?

Investors often use technical analysis (like moving averages and RSI), monitor trading volume, and review industry news to spot trends and key price levels. Comparing BMNR’s performance to peers also helps provide context.

Is BMNR considered a risky investment?

Like most mining and exploration stocks, BMNR carries above-average volatility and potential for abrupt price changes. Due diligence and appropriate risk management are strongly recommended.

How do I stay updated on BMNR stock news?

Set up price alerts and newsfeeds via trading platforms, follow reputable financial media outlets, and monitor official company announcements to stay informed about developments affecting BMNR.