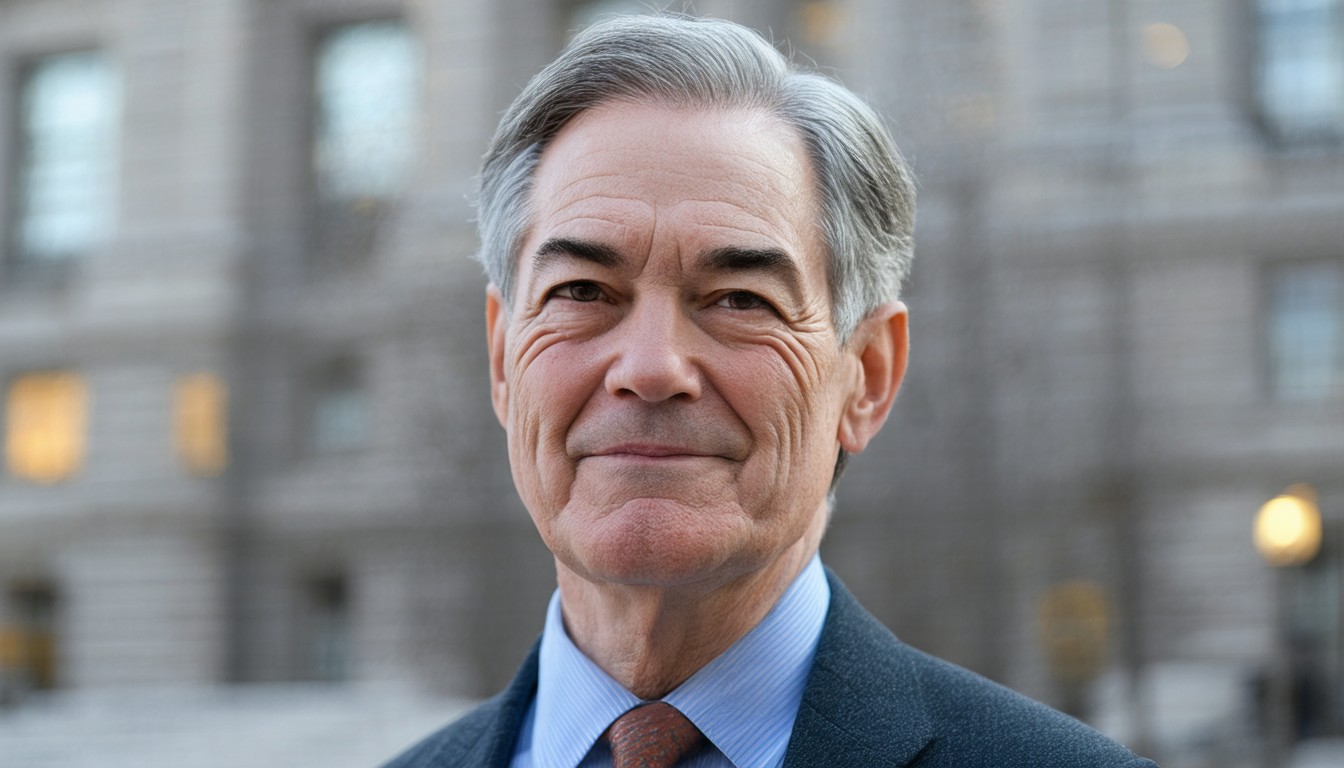

Fed Chair Powell: Key Insights on Monetary Policy and Economic Outlook

Jay Powell, Chair of the U.S. Federal Reserve, stands at the center of global economic discourse, his decisions shaping interest rates, financial markets, and household fortunes. Since taking office in 2018, Powell has steered the Fed through crises and recoveries, from a pandemic-induced recession to persistent inflation and evolving labor markets. His policy signals and public remarks are dissected by investors, business leaders, and policymakers worldwide. As the economic landscape shifts, Powell’s stewardship remains both an anchor and a lightning rod for debate on the Fed’s approach to inflation, recession risks, and long-term growth.

Powell’s Approach to Monetary Policy: Flexibility in Challenging Times

At the core of Jerome Powell’s leadership is a pragmatic, data-driven approach. Unlike some predecessors known for rigid adherence to economic doctrine, Powell has consistently emphasized the importance of policy flexibility. His response to the COVID-19 downturn was marked by swift and unprecedented easing: slashing rates to near zero, launching asset purchase programs, and extending support to credit markets.

As inflation spiked in the aftermath of pandemic disruptions, Powell pivoted—moving away from transitory explanations and adopting a more hawkish tone. The series of rate hikes that followed reflected a recalibration, signifying a willingness to act decisively in the face of persistent inflationary pressures. This adaptability has become a hallmark:

“We are committed to using our tools to return inflation to our 2% goal, while recognizing the uncertainties and risks in both directions,” Powell said in a recent press conference, underscoring the balance between inflation control and economic growth.

Data-Dependent Decision Making

Powell’s frequent references to “incoming data” are not simply rhetorical. The Federal Open Market Committee reviews a wide range of indicators—labor market strength, wage growth, consumer spending trends, and international developments—before making policy moves. This ongoing vigilance enables the Fed to adjust its trajectory as needed, though it can also create uncertainty about the timing and magnitude of future actions.

Balancing Act: Inflation, Employment, and Growth

A key challenge during Powell’s tenure has been navigating the so-called dual mandate: achieving maximum employment and price stability. In practice, the tension between these goals often intensifies during periods of supply shocks or wage acceleration. Under Powell, the Fed initially prioritized full employment during the pandemic; as inflation climbed beyond target levels in later years, the focus shifted to reining in price pressures, even at some cost to job gains.

Real-World Impacts: Markets, Mortgages, and Main Street

The ripple effects of Powell’s policy announcements are felt not just in bond markets but in the everyday lives of Americans. Each major Fed meeting is watched closely for clues about the direction of borrowing costs, investment flows, and economic sentiment.

Interest Rates and Financial Markets

Throughout 2022 and 2023, a series of rapid interest rate increases—faster than any cycle since the 1980s—sent shockwaves through stock and bond markets alike. Mortgage rates surged, putting pressure on homebuyers and slowing housing starts. At the same time, higher yields attracted global capital to U.S. assets, strengthening the dollar and impacting trade balances.

Anecdotal reports from business owners and anecdotal data suggest sectors such as construction, real estate, and discretionary retail have felt the brunt of tighter financial conditions. Meanwhile, tech companies and exporters have faced challenges from a strong dollar and higher capital costs.

Effects on Households and Employment

Even as job growth has remained relatively resilient, rising rates have created new hurdles for consumers. Auto loan and credit card rates have climbed, forcing many households to reassess spending. For some workers, particularly in interest-sensitive sectors, layoff risks have marginally increased, though overall unemployment has stayed near historically low levels.

Communication Strategy: Managing Expectations in an Uncertain World

Central banking is as much about communication as it is about economics. Powell has made transparency a core feature, regularly holding press conferences and testifying before Congress. The so-called “dot plot”—which shows the range of policymakers’ interest rate forecasts—is closely scrutinized for signals about future moves.

Clarity and Credibility

At times, Powell’s candor about uncertainty or evolving risks has reassured markets that the Fed is both vigilant and ready to adapt. However, critics argue that shifting language—such as the move from “transitory” inflation to a more hawkish stance—can sow confusion and volatility.

“The credibility of the central bank rests on clear communication and consistent action,” notes economist Diane Swonk. “Powell’s willingness to change course reflects pragmatism, but it carries the cost of managing evolving expectations in real-time.”

Lessons from Past Cycles

In the aftermath of the global financial crisis, the Fed under predecessors like Ben Bernanke experimented with forward guidance—committing to future actions to influence current expectations. Powell has continued this legacy, but with greater emphasis on conditionality: future moves are always contingent on how the data unfolds. The experience of the last few years underscores the challenge of providing certainty in an unpredictable world.

Looking Ahead: Rate Paths, Risks, and Economic Outlook

The future direction of Fed policy under Powell hinges on evolving economic data and global developments. Current debates focus on when the Fed might pause or reverse recent rate hikes, particularly as inflation shows signs of moderation but remains above target. Some forecasters anticipate a gradual easing later in the year if inflation continues to recede and growth risks rise, while others warn that persistent wage pressures could require a higher-for-longer stance.

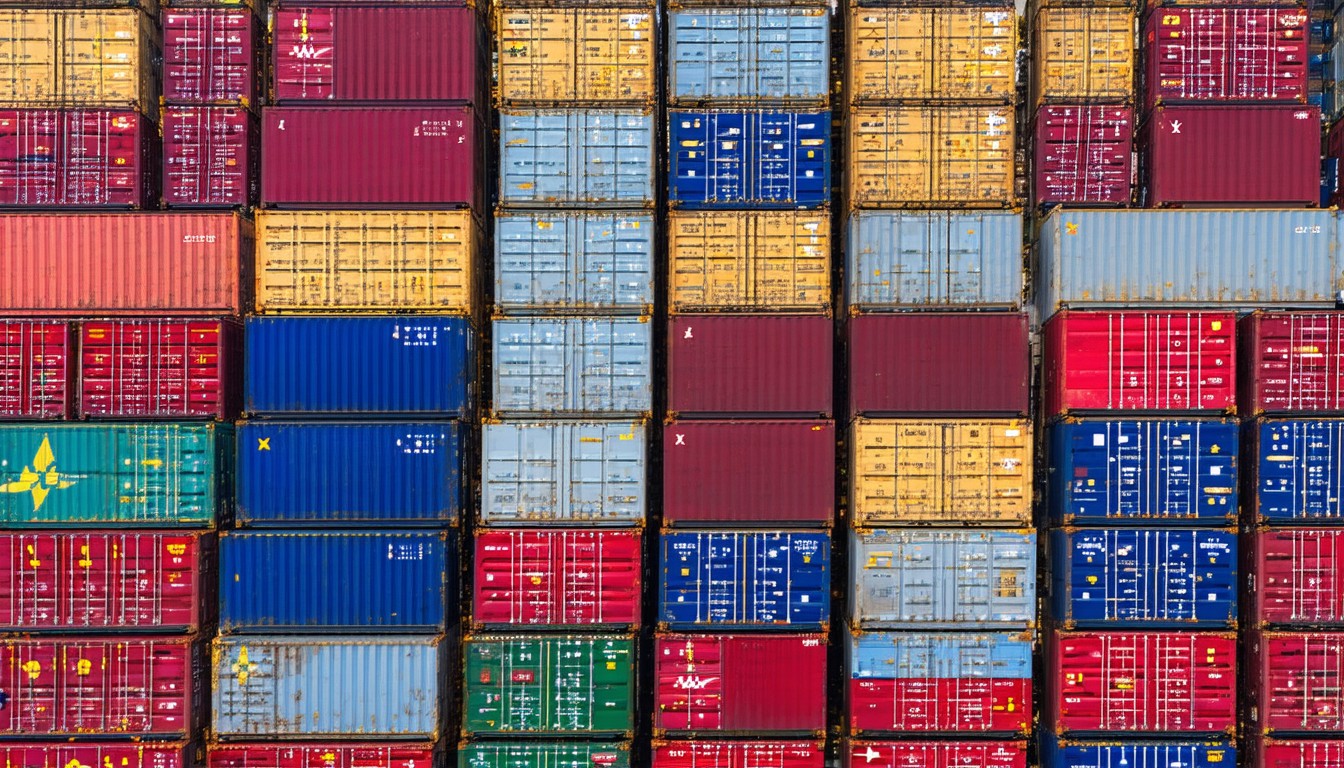

Global Context and Geopolitical Factors

Beyond domestic data, Powell’s Fed must navigate global shocks: supply chain realignment, energy price volatility, and geopolitical tensions. As the world’s primary reserve currency issuer, the U.S. central bank’s actions also reverberate through emerging markets, often dictating capital flows and exchange rate crises elsewhere.

Policy Tools and Limitations

While the Fed wields powerful tools—interest rates, balance sheet operations, regulatory oversight—Powell has repeatedly acknowledged the limitations of monetary policy alone. Structural issues such as technology-driven productivity changes, fiscal imbalances, and demographic shifts often lie beyond the reach of rate setting.

Conclusion: Navigating Uncertainty with Steady Leadership

Under Chair Powell, the Federal Reserve has demonstrated both the agility to respond to shocks and the resolve to tackle entrenched inflation. The balancing act between sustaining growth and containing prices remains the central challenge. Powell’s adaptive, communicative leadership continues to influence economic decisions from Wall Street to Main Street. As new risks and opportunities emerge, the evolution of Fed policy under Powell will remain a critical barometer for the U.S. and global outlook.

FAQs

What is Fed Chair Powell known for?

Jerome Powell is recognized for his pragmatic and flexible approach to monetary policy, especially his responses to economic shocks like the COVID-19 pandemic and inflation surges.

How does Powell influence interest rates?

As Chair of the Federal Reserve, Powell directs decisions on interest rate changes, which impact borrowing costs, investment, and broader economic activity.

Why does the Fed focus on both inflation and employment?

The Fed’s dual mandate directs it to achieve price stability and maximum employment, requiring careful balance since the two can sometimes be in tension.

Has Powell’s Fed changed its approach recently?

Yes, Powell has shifted from an accommodative stance during the pandemic to more aggressive interest rate hikes in response to persistent inflationary pressures.

What should investors watch for in Powell’s policy updates?

Investors closely monitor Powell’s statements for clues on future rate moves, changes in economic outlook, and signals about how the Fed interprets new data.