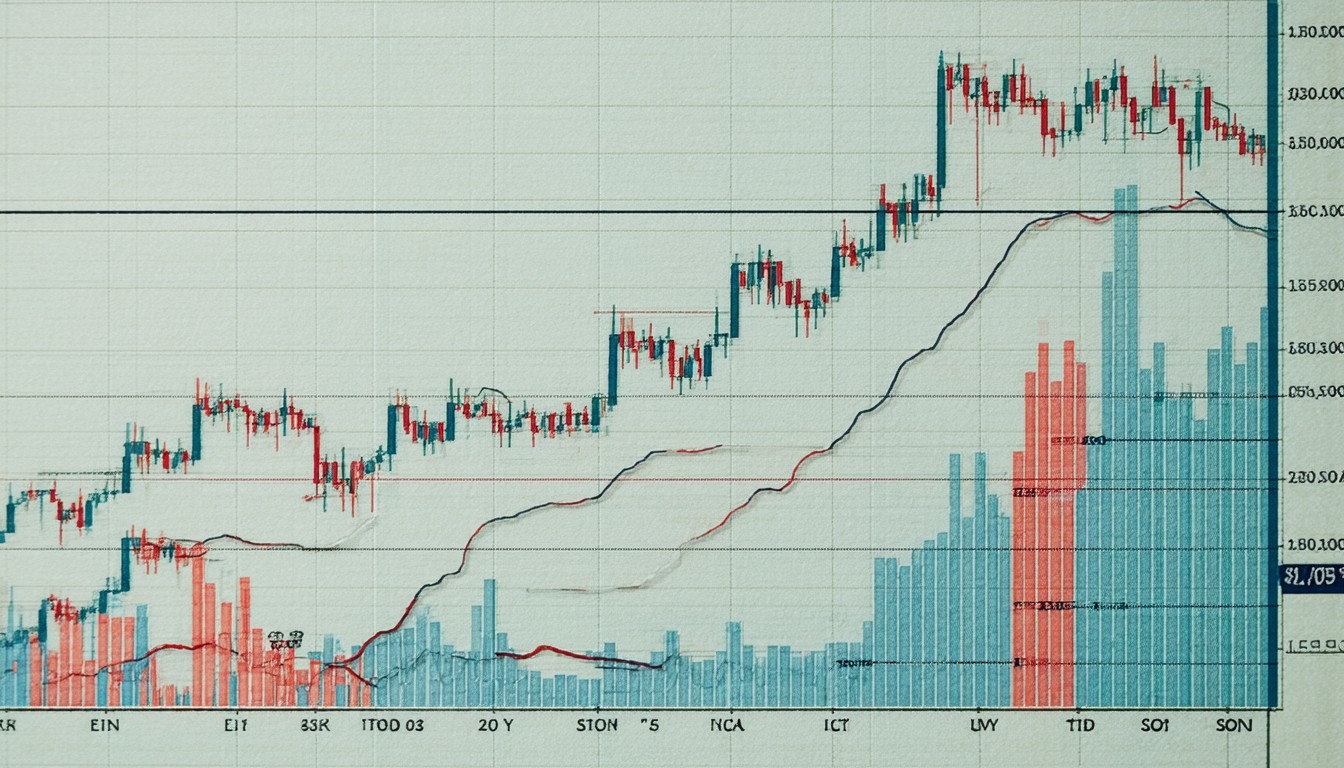

U.S. Treasury Yields 2025: Forecasts, Trends, and Investment Insights

U.S. Treasury yields occupy a central role in both the global financial system and everyday investment decisions. As benchmarks for everything from mortgage rates to corporate borrowing costs, their direction in 2025 is a subject of intense interest for policymakers, institutional investors, and individual savers alike. With 2024’s financial markets characterized by stubborn inflation, shifting Federal Reserve policies, and growing fiscal imbalances, the outlook for 2025 is anything but straightforward.

Forecasting Treasury yields, particularly for the key 2-year and 10-year notes, requires a nuanced understanding of economic trends, monetary policy, fiscal dynamics, and global capital flows. In this piece, we explore the latest forecasts for 2025, dissect recent market movements, and highlight strategies investors are leveraging as they navigate an uncertain interest rate environment.

Macro Trends Shaping U.S. Treasury Yields for 2025

Several interconnected factors are at the heart of Treasury yield projections for the coming year. No single force moves rates in isolation; rather, yields reflect a complex interplay between U.S. economic health, inflation expectations, Federal Reserve actions, and fiscal policy.

Inflation and Fed Policy: The Dual Engines

After years of ultra-low yields, 2022-2024 saw an aggressive Fed tightening cycle intended to tame surging post-pandemic inflation. By late 2024, debate persists as to whether central bankers have succeeded, with inflation measures remaining sticky in many sectors. According to market consensus, the Fed is expected to begin gradually lowering rates in 2025 if inflation shows sustained cooling.

A senior economist at Brookings notes:

“The market’s expectations for rate cuts have shifted constantly, hinging on the Fed’s delicate balancing act between supporting growth and avoiding a resurgence of inflation.”

Forward guidance suggests the Federal Funds Rate could decline modestly, but not to the near-zero levels of the prior decade. As a result, 2025 Treasury yields are projected to moderate but remain above long-term post-2008 averages.

Fiscal Policy and Treasury Supply

Another vital influence is U.S. fiscal policy. With record deficits stemming from COVID-era spending and new industrial policy initiatives, the Treasury Department faces continued hefty bond issuance. This rising supply may put upward pressure on yields—especially if foreign demand softens or investors demand higher returns for perceived risk.

In practical terms, a greater supply of Treasuries can cause bond prices to fall, which pushes yields higher. The 10-year Treasury note, a widely watched benchmark, has seen significant volatility as markets digest both macro data and Washington’s fiscal negotiations.

Global Capital Flows and Geopolitics

The global appeal of U.S. Treasuries has long provided a “safe haven” anchor amid uncertainty. In 2025, potential disruptions—from geopolitical tensions to lingering pandemic aftershocks or energy market shocks—could cause flight-to-quality buying, temporarily lowering yields despite domestic pressures.

Conversely, persistent dollar strength or improved returns abroad could lure some buyers away, modestly lifting yields. Observers stress that the interconnectedness of developed market bonds makes U.S. yields sensitive not just to domestic headlines but to the broader global risk appetite.

Current Forecasts for 2025 U.S. Treasury Yields

Forecasts for the trajectory of Treasury yields in 2025 vary among leading banks and economic research houses, reflecting ongoing volatility in macro data and uncertainty around major policy moves.

10-Year Treasury Yield Projections

- Wall Street Outlook: Many major banks anticipate 10-year yields remaining in a range between 3.5% and 4.5% for much of 2025, assuming a gradual Fed easing cycle and steady (though elevated) inflation relative to the 2% target.

- Survey Data: In recent analyst surveys, a plurality expect yields to end 2025 near the lower end of that range if inflation reverts to trend and growth cools. Should inflation prove more stubborn or deficits widen unexpectedly, the upper end is plausible.

Short-Dated Yields (2-Year, 5-Year)

Shorter-dated yields, which track more closely to the Fed’s policy rate, could see more pronounced drops if the central bank cuts rates as projected. However, volatility is expected, particularly following major economic releases or policy updates.

Range of Scenarios

- Soft Landing: A scenario in which inflation falls without triggering a sharp recession could stabilize yields in the mid-3% to low-4% range.

- Stagflation or Fiscal Shock: Persistently high inflation, major fiscal stress, or foreign selling could send yields above 5%.

- Unexpected Downturn: A recession or global crisis could prompt a rapid flight to safety, driving yields lower.

Implications for Investors: Strategies and Risks

Investors in Treasuries and Treasury-driven products must weigh the risks and opportunities presented by this environment. Market participants are not only focused on yield levels but also on the shape of the yield curve and the broader portfolio context.

Portfolio Positioning in a Shifting Rate Environment

- Laddering Maturities: Many experts recommend a laddered approach, spreading investments across different maturities to manage reinvestment risk.

- Duration Management: Shortening duration may be prudent if yields are expected to rise, while extending duration could be considered if rate cuts seem likely.

- Inflation Hedging: Some investors are incorporating Treasury Inflation-Protected Securities (TIPS) or combining Treasuries with real assets as a hedge.

Opportunities in Volatility

Bond market volatility can create tactical entry points for active managers. For instance, sharp selloffs often result in oversold conditions, which can offer attractive entry points for long-term investors.

Real-World Example

In 2023-2024, funds tracking the Bloomberg U.S. Aggregate Bond Index experienced record inflows whenever yields spiked above 4%, illustrating that institutional buyers still see value in Treasuries at higher nominal rates.

Influencing Factors to Monitor Throughout 2025

Economic Indicators

Regular updates on inflation, employment, and GDP growth will be closely watched. Any surprises versus expectations can trigger immediate bond market reactions.

Policy Announcements

Key moments include Federal Open Market Committee (FOMC) meetings and fiscal negotiations in Washington. Signals about future rates and deficit trajectories will heavily influence yield projections.

Global Events

Geopolitical risks, natural disasters, and policy changes abroad—as evidenced in recent years by the Ukraine conflict and energy price swings—will continue to affect the relative attractiveness of U.S. debt.

Conclusion: Navigating U.S. Treasury Yield Uncertainty in 2025

The outlook for U.S. Treasury yields in 2025 is shaped by a mosaic of domestic and international forces. While experts anticipate yields may moderate from 2024’s peaks, the range of credible outcomes remains unusually wide. Successful investors will need to stay nimble, monitor multiple risk factors, and adapt portfolio strategies as new data emerges. For those seeking stability and relative safety, Treasuries should continue to play a central role—albeit in an ever-evolving financial landscape.

FAQs

What are U.S. Treasury yields and why are they important?

U.S. Treasury yields represent the return investors earn on government bonds. They influence interest rates across the economy and serve as benchmarks for everything from mortgages to corporate borrowing.

How do inflation and Federal Reserve policy affect Treasury yields?

When inflation rises or the Federal Reserve raises short-term rates, Treasury yields typically increase. Conversely, if inflation cools and the Fed cuts rates, yields are likely to fall or stabilize.

What is the 10-year Treasury yield forecast for 2025?

Most analysts project the 10-year Treasury yield to remain in the 3.5% to 4.5% range, assuming stable growth and gradual Fed rate cuts. Unexpected inflation or fiscal shocks could push yields higher.

Are U.S. Treasuries still considered a safe investment for 2025?

Yes, U.S. Treasuries remain a global benchmark for safety, providing principal protection and liquidity. However, changing yields mean investors should monitor markets closely for risk and opportunity.

How can investors manage risk amid yield uncertainty?

Investors often ladder maturities, use duration management, or include inflation-protected bonds to navigate changing yield environments. Staying diversified and monitoring economic indicators is also prudent.

What events could significantly impact Treasury yields in 2025?

Key factors include Fed policy shifts, inflation surprises, U.S. fiscal developments, and major global events or geopolitical tensions. Rapid changes in any of these could lead to yield volatility.